The accounting and finance industry is undergoing seismic shifts, fuelled by technology and changing regulatory landscapes. Efficiency and compliance are no longer nice to have—firmly in the must-have category—so they can work in the Goods and Services Tax (GST) environment. Accounts Payable (AP) procedures, from receiving, validating, and paying supplier bills, can be involved and time-critical. Earlier, these processes relied on manual data entry, paper invoices, and manual authentication, all of which were cumbersome. Now, however, technology has brought a better way. GST-compliant AP automation software is now a potent tool for contemporary businesses to facilitate more precise, faster, and more transparent financial management.

Knowing AP Automation

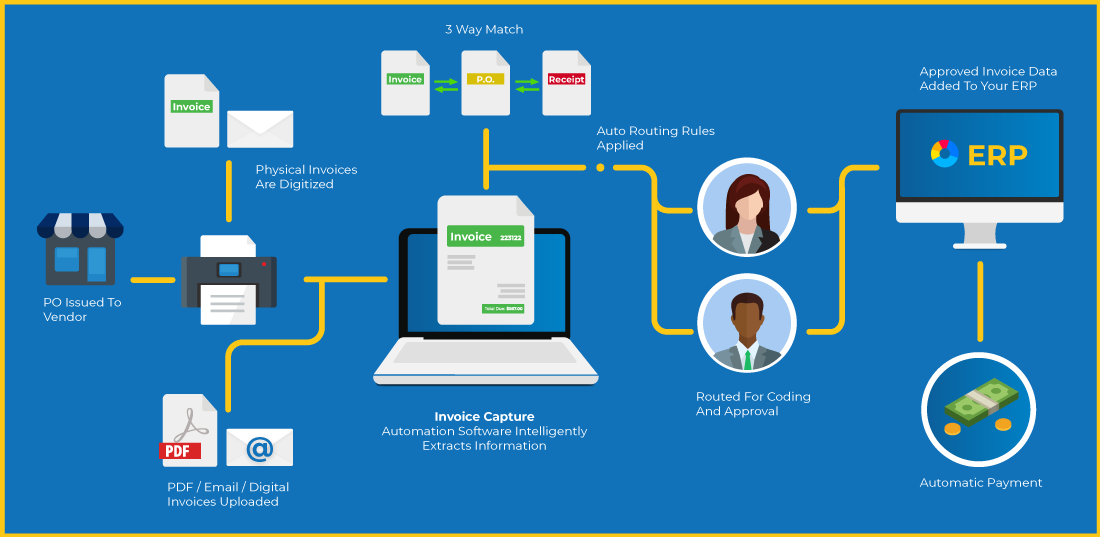

Accounts Payable automation is the application of technology to digitise and automate work activities in the AP process. Rather than manually entering invoice data by accountants, automation pulls, verifies, and posts information rapidly and accurately. Automation also adheres to regulatory requirements, such as GST, to help companies meet the legislation when dealing with their accounts.

What is groundbreaking about AP automation is that it can combine efficiency with regulatory compliance. Instead of compliance being an added process, newer systems combine it as a natural extension of processes. With this, AP automation software with GST compliance is a required pillar of support for businesses that aspire to bring transparency and accuracy to financial processes.

Why GST Compliance is Important in AP Processes

The launch of GST simplified the tax scenario in India, but at the same time increased the need for proper recording and reporting. Invoices have to be posted with the right GST detail so that taxes can be filed without any problem, and input credits can be utilised without any hassle. Incorrect GST postings can result in late credits or lengthy filings, leading to out-of-balance books of account.

When AP processes are processed manually, such risks are increased since human errors are prevalent. Automation ensures such risks are reduced. AP automation software is GST-compliant, captures invoice information with precision, posts the right tax codes, and posts records according to GST guidelines. This makes filing taxes seamless and avoids compliance issues.

Automation: Bringing Efficiency to Invoice Processing

In a manual process, invoices are received via email or hard copy, and then go through several stages of verification before payment. This naturally leads to delay, late due dates, and error postings. These obstacles are eliminated with automation. GST-enabled AP automation software scans or uploads invoices, and AI captures everything from vendor names to GST value.

The data is automatically checked against rules and policy regimes, and the invoice is sent for approval faster than with manual processing. This not only enables timely payments but also alleviates the workload from finance teams so that they can concentrate on more analytical and strategic tasks instead of getting overwhelmed by performing recurring tasks.

Improving Data Accuracy

The benefit of automation is that it reduces errors to a great extent. Companies dealing with hundreds of bills during a month cannot risk making mistakes in records. Manual data entry will always lead to duplication, missing, or incorrect tax calculation. AP automation software GST-enabled prevents error-prone data entry by cross-verifying entries against tax regulations and in-house policies in real time.

Where discrepancies on invoices appear, the software detects them immediately, allowing the finance team to resolve them before they snowball into major problems. This means that the company’s books are leaner, truer, and always in compliance with tax requirements.

Glenecking Vendor Relationships

Timely and correct payments are important to fostering good vendor relations. Mistakes or delays within the AP process can anger suppliers and strain relationships. Automation of AP processes guarantees vendors receive timely payments and invoices are processed without back-and-forth clarifications that have to be repeated.

With the help of AP automation software that is GST compliant, companies also reconcile tax credits with their vendors, thus instilling confidence. Both parties achieve a clean and accurate process with a long-term professional relationship, promoting growth and efficiency.

Real-Time AP Data Visibility

A contemporary business entity requires real-time data to make timely decisions. Manually processed AP processing will more than likely deprive visibility of liabilities and costs until the entry of data is completed. With automated processing, companies get real-time visibility into their accounts.

AP automation software that is GST-compliant offers dashboards and reports that present an overview of payments pending, bills settled, cumulative GST input credits, and overall expense distribution. Analysis in real-time keeps the managers aware and assists them in making financial decisions that steer the company in the correct direction.

Facilitating GST Input Tax Credit Claims

One of the most significant GST compliance sectors is input tax credits. Recovery of credits is achieved through correct coordination between supplier invoices and GST returns. As soon as invoices get lost or are entered incorrectly, companies miss out on recoverable credits.

All the invoices are automatically captured, recorded, and matched with GST filings through automation. This helps avoid tax credits being left out and ensures compliance on a regular basis. AP automation software with GST compliance is therefore a financial as well as a compliance shield for organisations that have enormous volumes of transactions.

Enhanced Audit and Compliance Readiness

Internal and external audits demand complete financial leads. Manual systems tend to create gaps automatically, whereas automated AP systems retain a complete history of all invoices, approvals, and tax data. When verifying compliance, companies can provide confirmed and formatted data in real time.

Automation not just simplifies the audits but also enhances the overall corporate governance. By ensuring that each invoice is processed in accordance with the law, GST-compliant AP automation software fosters a culture of accuracy and accountability.

Conclusion

Tax compliance and management of accounts payable are the top priorities of every contemporary business. Manual process can suffice in the initial stage, but causes inefficiency, delay, and compliance issues as the company expands. AP automation software integration with GST compliance revolutionises the process of invoice, payment, and tax report management for businesses.

Through AP process automation, companies get quicker invoice processing, accurate data, seamless compliance, and better vendor relationships. They gain real-time financial insight, enhanced input tax claim, and a secure, transparent audit and governance framework. Above all, automation enables finance departments to spend time on growth and planning instead of doing the same thing over and over again.